Step 6 - Upload Digital Signature Certificate (DSC), if applicable.

Step 5 - Select the appropriate ITR, Assessment Year and XML file previously saved in Step 2 (using browse button). Step 4 - Go to e-File and click on "Upload Return".

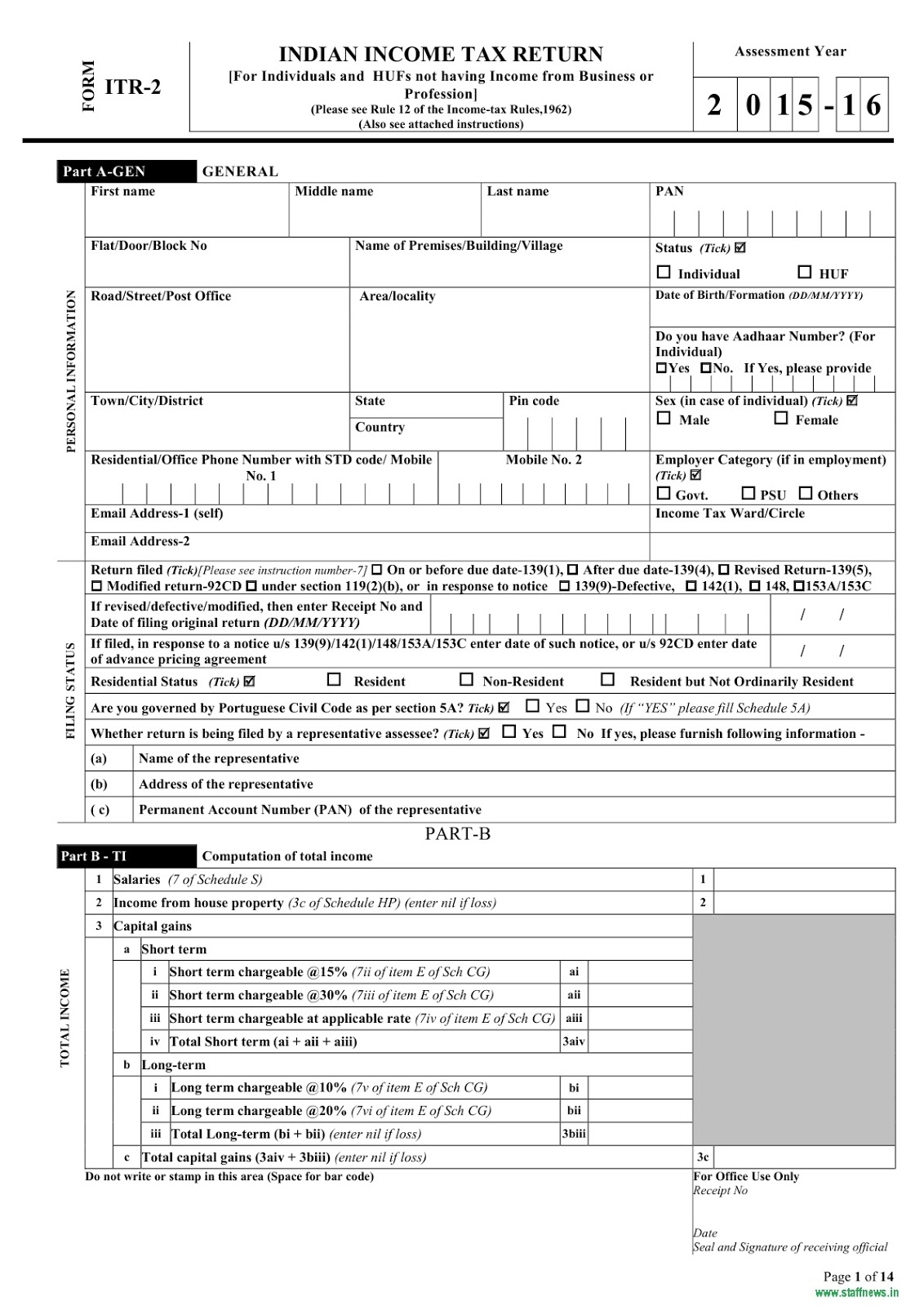

Step 3 - Login to e-Filing website with User ID, Password, Date of Birth /Date of Incorporation and enter the Captcha code. Step 2 - Prepare the Return using the downloaded Software. Step 1 - Download the ITR preparation software for the relevant assessment year to your PC / Laptop from the "Downloads" page. However, you can eliminate the need to knock on the doors of Chartered Account or experts, the department makes it very easier and flexible their via e-filing portal. Who cannot file ITR form 2?įorm ITR - 2 cannot be used by an individual and HUF whose total income for the year includes income from profit and gains from business or profession and also having income in the nature of interest, salary, bonus, commission or remuneration, by whatever name called, due to, or received by him from partnership firm. Form ITR – 2 can be used by an individual and Hindu Undivided Family who is not eligible to file ITR-1 Sahaj and not having income from “profit and gains of business or profession” and also not having income from “Profits and gains of business or profession” in the nature of interest, salary, bonus, commission or remuneration, by whatever name called, due to, or received by him from a partnership firm.įurther, in case where the income of another person like spouse, minor child, etc., is to be clubbed with the income of the taxpayer, this Return Form can be used if income to be clubbed falls in any of the above categories.

0 kommentar(er)

0 kommentar(er)